Skrill Casinos

What is the first name that comes to mind when discussing digital wallets? I hear you all saying Skrill. Although we have never underestimated its vogue, we must also accept that the recent sponsorship of AC Milan added to its ever-growing popularity in the online payment solutions area.

With its recent loyalty program, Knect, Skrill now pleases its global users by offering them loyalty points for each Skrill payment transaction. Skrill users may eventually benefit from the rewards once their points reach a certain level.

The rewards include cash gifts, additional discounts, and exclusive offers just for Knect-owning Skrill users. However, the most frequent question for those new to online gambling payments may be ‘What is Skrill?’. We will dig deeper into the subject and help you evaluate Skrill per your needs and expectations.

What Is Skrill?

With its downloadable apps on Google Play and App Store, Skrill is a digital wallet you can use for almost all financial activities. You can complete online payments, send money to your friends, family, or business partners, buy cryptocurrencies, and even withdraw money to your bank account.

The uniqueness of the Skrill e-wallet derives from the extreme speed of the transactions, ease of use and convenience of using numerous payment methods, lower fees, higher limits for money transfers, extra benefits, excellent customer support, and global acceptance. Unlike most digital wallets, Skrill is beyond a local app; however, Skrill users’ numbers increase gradually.

How Does Skrill Work?

Using Skrill is simple to learn. You should download the app, create a Skrill account, and fund your account with credit or debit cards, Paysafecards, bank transfers, and other payment methods, whose details you can reach by visiting the homepage of Skrill. Once you deposit the amount you want to your Skrill account, you can use it as you like.

From that moment on, you can state the amount, the countries of the sender and recipient, the selected currency, payment instrument, and the recipient’s data and then confirm the transaction to proceed. You will complete the transfer quickly and with fewer fees than traditional payment methods. Using Skrill will help you to catch up with the day.

In Which Countries Is Skrill Available?

Skrill countries expand daily and, thus, are subject to change, and it is best to check the Skrill website’ ‘Non-serviced Countries’ section. Currently, Skrill does NOT offer its services to the following 116 countries:

- Afghanistan, Aland Islands, American Samoa, Angola, Anguilla, Antarctica, Antigua and Barbuda, Barbados, Belize, Benin, Bhutan, Bonaire (including Sint Eustatius and Saba), Bouvet Island, British Indian Ocean Territory, Burkina Faso, Burundi, Cape Verde, Central African Republic, Chad, Cocos (Keeling) Islands, Comoros, Congo, Democratic Republic of Congo, Cook Islands, Crimea, Cuba, Curacao, Donbas, Djibouti, Equatorial Guinea, Eritrea, Faroe Islands, Fiji, French Guyana, French Polynesia, French Southern Territories, Gabon, Gambia, Greenland, Grenada, Guadeloupe, Guinea, Guinea-Bissau, Guyana, Haiti, Heard Island and Mcdonald Islands, Holy See (Vatican City State), Iran, Iraq, Ivory Coast (Côte d’Ivoire), Japan, Kherson, Kiribati, Kosovo, Kyrgyzstan, Lao People’s Democratic Republic, Lebanon, Liberia, Libya, Macao, Mali, Marshall Islands, Martinique, Mauritania, Mayotte, Micronesia, Montserrat, Myanmar, Nauru, New Caledonia, Niger, Niue, Norfolk Island, North Korea, Northern Mariana Islands, Palau, Palestinian Territory, Papua New Guinea, Reunion, Pitcairn, Rwanda, Saint Barthelemy, Saint Helena, Saint Kitts and Nevis, Saint Lucia, Saint Martin, Saint Pierre and Miquelon, Saint Vincent and the Grenadines, Sao Tome e Principe, Seychelles, Sierra Leone, Sint Maarten, Solomon Islands, Somalia, South Georgia and the South Sandwich Islands, Sudan (North and South), Suriname, Svalbard and Jan Mayen, Syria, Tajikistan, Timor-Leste, Togo, Tokelau, Tonga, Turkey, Turkmenistan, Turks and Caicos Islands, Tuvalu, Vanuatu, Venezuela, Wallis and Futuna, Western Sahara, Western Samoa, Yemen, Zaporizhzhia, and Zimbabwe.

In other words, you can use your Skrill account and transfer your finances to any country except the ones above for the time being. Although the list above appears long, the number of the remaining countries where you can benefit from Skrill’s exquisite services is 79.

The website is available in multiple languages, including Chinese, Czech, English, English for India, English for the USA, French, German, Greek, Italian, Polish, Portuguese, Russian, Spanish, and Spanish for the USA.

Is Skrill Safe?

The wisest question to ask yourself must be about safety if money is involved. That rule would apply to your payment method and to the platform where you plan to use your digital wallet. That means you must also evaluate the safety, security, and confidentiality of your e-commerce platform, online casino, online bookie, or any other forum you plan to use.

It is impossible to guarantee your transactions’ safety without checking them both. So, there is nothing wrong with questioning your potential digital wallet’s safety, security, and confidentiality measures.

In this section, we will evaluate the features of a trustworthy payment solution platform and then compare it with the qualities of Skrill with those criteria.

This comparison would either create an image that will fulfil your expectations or help you decide not to prefer Skrill. However, we strongly suggest you also make your own evaluations; you may have other criteria than ours!

Features of a Reliable Payment Platform

As per our expert team’s approach, the features of a reliable payment platform cover a wide range, but some are not open to questioning. These vitally essential features are the security measures of the forum, the available payment options, the validity of the platform at the global scale, the foreseeability of the fees, and finally, the measures taken regarding your privacy and confidentiality.

Let’s see how Skrill’s qualities are according to them all individually.

Security and Encryption

One of the primary reasons why more and more people gradually start to use Skrill for their online payments derives from Skrill’s approach towards its users’ security. As a fraud-aware platform, Skrill offers an anti-fraud monitoring system, which means if an unusual transaction appears suspicious, Skrill can block it to protect it.

Additionally, Skrill uses two-factor authentication and a 128-bit encrypted Secure Socket Layer (SSL) technology to protect all your details, including details about your Skrill login, personal data, money transfers, and spending habits. That means you don’t have to worry about whether anyone could see your data while you are using this payment method.

Multiple Payment Options

Having more than one option in terms of payment methods is also another great feature of Skrill. Unlike most digital wallets, Skrill offers credit and debit cards, Paysafe cards, bank transfers, and other payment methods as options for depositing your account. You can choose the suitable option among your available methods and use them to fund your digital wallet.

Global Accessibility

The more widespread your digital wallet gets accepted, the more accessible and flexible you will become in completing your financial transactions. You can use your payment method twenty-four hours a day and seven days a week.

Holding a Skrill account lets you transfer your funds quickly and securely. You know what you should do to benefit from this freedom: Register with Skrill and create your account!

Transparent Fees

We never welcome unexpected outcomes; we all want to know how much we must pay for a service in return. With its already low and competitive fees, Skrill is the best option for those who plan to use their digital wallet regularly.

The costs are present and transparently revealed on the platform’s website, meaning you can always visit and check whether they are subject to any changes. At the moment, Skrill’s fees for the local transfers are as follows:

- Bank transfers: 0%.

- Rapid transfers: Up to 1%.

- Paysafe Cash: Up to 2.5%.

- Paysafecard: Up to 5%.

Skrill offers the following fees for international transfers:

- Card Diners: 1.25%.

- Card JCB: 1.25%.

- Card Mastercard: 1.25%.

- Card Visa: 1.25%.

Privacy and Data Protection

The most crucial part of every bilateral relationship is the set of rules. Since privacy and data are issues that cannot be interpreted apart from the platform and user relationship, this title also plays a vital role in determining your ideal online payment method.

These rules bind both parties, which means the content of the regulations will directly affect your user experience of the platform.

The privacy and data of Skrill users are under the platform’s protection. Skrill publishes its comprehensive privacy policy on its website to inform its existing and potential users and enlighten them about the potential ultimate of their data.

This notice includes all the details of where Skrill keeps its users’ personal information, how long it retains them, the users’ rights for data protection, legal basis, and many others. So, we encourage you to go through the document to see Skrill’s transparent and professional approach to revealing its users’ data protection policies.

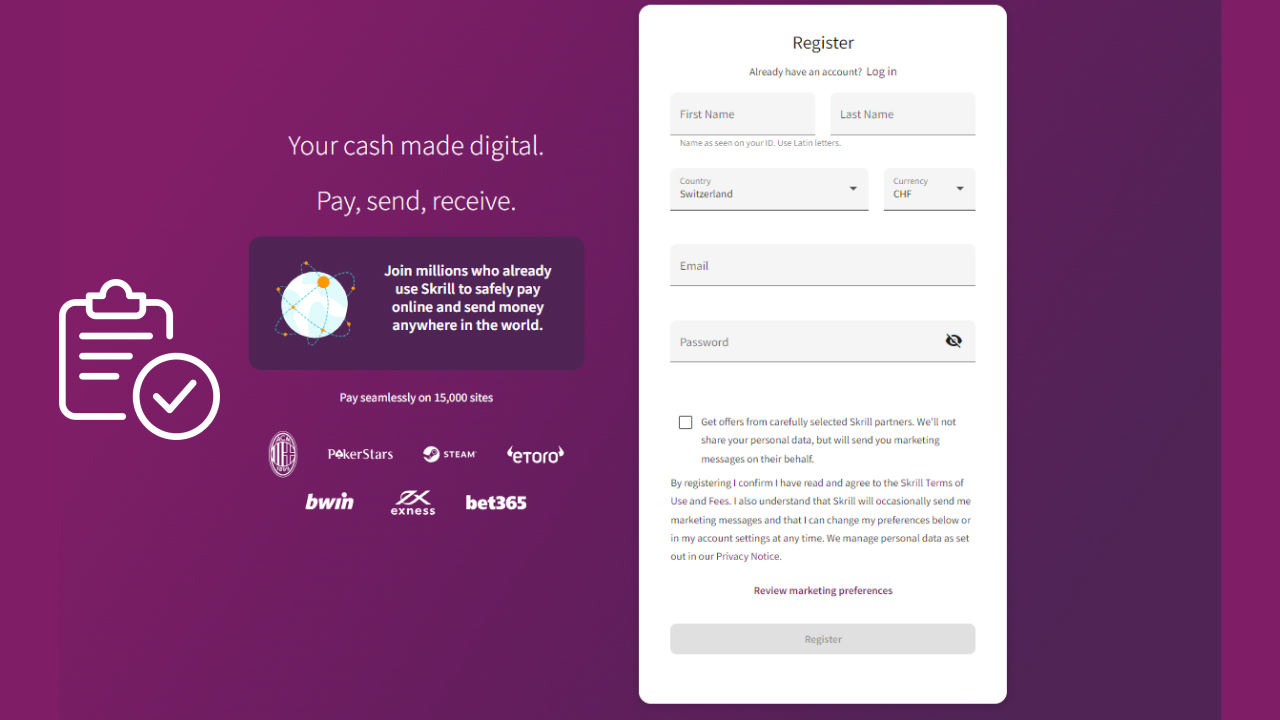

How to Create a Skrill Account?

Creating a Skrill account is straightforward. Just do the following to hold your account:

- Visit Skrill’s website.

- Click on the dark cherry-coloured ‘Register’ button.

- Type the data the website demands from you, including your first name, last name, e-mail address, and password, consisting of eight characters, one symbol or number, and one letter.

- Select your country of residence among the present options. Find your country by scrolling down the alphabetical list.

- Select your preferred currency for your payments.

- Click on the small box to give your consent for Skrill to send you marketing messages.

- Tap on the ‘Register’ button again to complete your registration.

From now on, you can log in to your account by typing your username and password; however, your account will be limited to a certain amount until you complete your verification process. To start your verification process, just do the following:

- Log in to your account.

- Make your first deposit by clicking on the ‘Pay Online’ section.

- The system will direct you to a payment form where you should type your current address, including your postal code, date of birth, and mobile number.

- Click on the ‘Next’ button below.

- You will receive a code via SMS. Type it into the box on the screen and click the ‘Verify’ button.

- Then, the system will demand that you create a PIN code you will use upon login or while sending and withdrawing money.

- Click on the ‘Save’ button.

- Then, you should provide a copy of your ID or driver’s license to prove your identity to the system. Please take a picture of them and upload it to the platform.

- Confirm that the photo is readable.

- Do the same for the back of the card as well.

- Move to the face verification step, where the system uses your camera to check your face details and prove whether your face is the same as the photo’s version.

- Once you submit your document, proceed to the final stage of the verification, which is verifying the address.

- Select the document type from the list, upload the address document, and click the ‘Continue’ button to finalize the verification phase.

Online Casinos Payment Methods

Online casinos do their best to offer almost all payment methods to meet the needs of every potential user. Especially if you visit prestigious online casino platforms, you will encounter numerous ways.

They may vary from traditional payment options like bank transfers and credit card payments to more up-to-date preferences like digital wallets, crypto payments, vouchers, and many others. Since Skrill is a famous e-wallet company, we will focus on digital wallets as the payment method for your online gambling adventure.

Digital Wallets

Undoubtedly, thanks to their lightning-fast transactions and adaptability, digital wallets have quickly become a key to the online gambling industry. These great alternatives serve as a go-between for your bank and the online casino, simplifying rapid online transactions while also adding a further layer of security.

Yet, a new question arises. How does a digital wallet function in practice? We can simply say that digital wallets enable you to load money from multiple sources.

You can use traditional banking systems, credit/debit cards, and even other digital wallets to transfer money among e-wallets. Once the money is in your e-wallet, moving it to your online gambling account is effortless. Isn’t it fascinating?

Since Skrill is among the most known digital wallets, almost every trustworthy casino platform attempts to cooperate with the company. Just having Skrill’s name on the payment methods section, or in other words, becoming a Skrill casino increases the platform’s trustworthiness.

It is also known that Skrill acts in concordance with the relevant legal regulation and acts picky in choosing their partners in every business area and online gambling. There are no exceptions to this rule.

Besides numerous advantages of Skrill, like the speed of both depositing and withdrawing activities, high level of safety and security measures taken, excellent data protection, ease of use, and global recognition, Skrill also adds value to its partner platforms’ images and increases the desirability of the forums.

Debit Cards

Since debit cards have been used for all sorts of online purchases for so long, it’s no surprise that many gamblers choose to use them while placing bets online.

Most online casinos accept major credit cards like Visa and Mastercard, and these cards are an excellent choice for players unwilling to deal with the complexity of other forms of payment.

- Ease of Use: One of the main advantages of using a debit card is the ease with which transactions can be carried out. Like any other online transaction, all you have to do is input your credit card information.

You don’t have to create a new account, recall new passwords, or undergo any of the hassles usually connected with these other options.

- Security Features: Card verification values (CVV codes) and two-factor authentication via a mobile banking app are only two of the security features available on debit cards. Those who are concerned about scams on the internet might appreciate these precautions.

- The Downside: On the other side, you’ll have to give the casino your credit card information, which may leave you exposed at some point despite the casino’s safety measures. Furthermore, withdrawal delays are higher, commonly ranging from three to five business days, and casinos often collect a small fee for using a debit card.

Bank Transfers

Bank transfers have been a staple in online transactions for as long as online gambling has existed. Their main draw is the inherent trust from dealing directly with established banking institutions.

- High Limits: Unlike e-wallets and debit cards, bank transfers often allow higher deposit and withdrawal limits. This particularly appeals to high rollers and serious gamblers who move significant amounts of money.

- Privacy: Bank transfers also provide an additional layer of privacy, as transactions won’t specifically detail that funds are for online gambling, which some players prefer for discretion purposes.

- Drawbacks: The downsides include the longer processing times, which can stretch to up to a week or more. This is significantly slower than e-wallets and debit cards. Also, both your bank and the casino might impose fees for transactions.

Popular Casinos Accepting Skrill

To be honest, we are all a bit puzzled when we click the deposit options in online casinos and sportsbooks. This is a common concern, and you are right to doubt. Skrill is a great alternative, and its popularity among players has grown.

The rising profile of the payment provider has been reflected in an increase of online gambling sites accepting the service as a payment option.

Indeed, Skrill is an outstanding choice for players who value a premium for rapid transactions, a high-security standard, and access to bonuses. Since it is widely accepted at the majority of online casinos, you can pick from an extensive range of sites.

All in all, if you’re searching for a hassle-free, swift, and secure online casino experience, look no further than those that accept Skrill. Here are some of the reliable and popular online casino websites you can take advantage of your Skrill account: